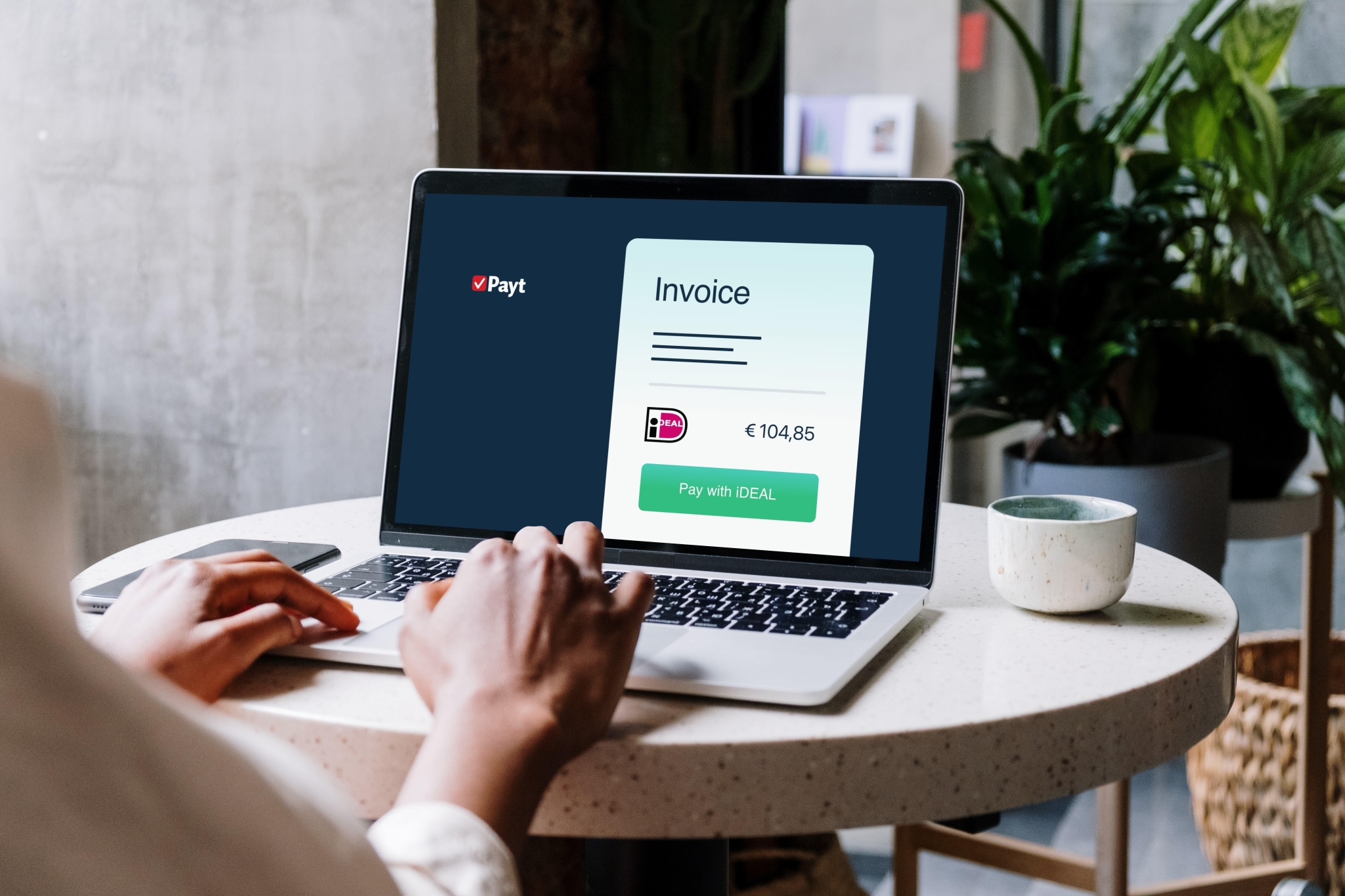

‘Automation’ and ‘a good customer relationship’: they seem to be opposites. The image of automation is often that it is impersonal: a computer takes over human work. But when you implement automation correctly, it contributes to the relationship with your customer and saves you work. This is how it works out for automated debtor management with Payt. The result: less work to get an outstanding invoice paid, just as friendly to your customers!

Engaging in dialogue per invoice

In the software of Payt, you can communicate per invoice: your customer can leave responses, such as questions or comments. You can then easily respond to them. There’s no need to search for the invoice, for example, in a mailbox: it’s right there!

Offering a payment plan or pause in processes per individual customer

Does a customer need extra attention, for example, in the form of a payment plan or a pause in the follow-up process? With Payt, you can easily pause the process per invoice or customer. Is your customer struggling to pay and you want to help? In Payt’s software, you or your customer can start a payment plan. It is also a personal and pleasant alternative to a collection case.

Waiving statutory collection costs

If it is unfortunately necessary to turn an invoice into a collection case, you keep it under your own management with Payt. You pay a fixed amount per collection. You are free to waive the statutory collection costs that you are allowed to charge your customer. An easy way to show goodwill in the event of non-payment – without your organisation suffering financially.

A quickly assisted customer, even with payments

Additionally, Payt offers you and your team the ability to keep notes per customer and per invoice. If your customer’s primary contact is unavailable, a colleague can assist the customer further. The colleague is quickly informed of the invoice history through the notes. And we don’t need to tell you what a quickly assisted customer does for customer satisfaction, even if it’s about an invoice!

The result

The result of automated debtor management while maintaining dialogue with your customers: just as friendly to your customers, and at the same time less work to receive payments.