For many, automation is something exciting. Handing over a process to a system is a hurdle for many companies. Change management is therefore an important part of the Payt implementation. We will relieve and support our customers as much as possible in the process towards full automation of accounts receivable management. My name is Bert-Jan Walters and I am an implementation specialist within Payt. Below, I try to outline the implementation process and how we relieve the customer.

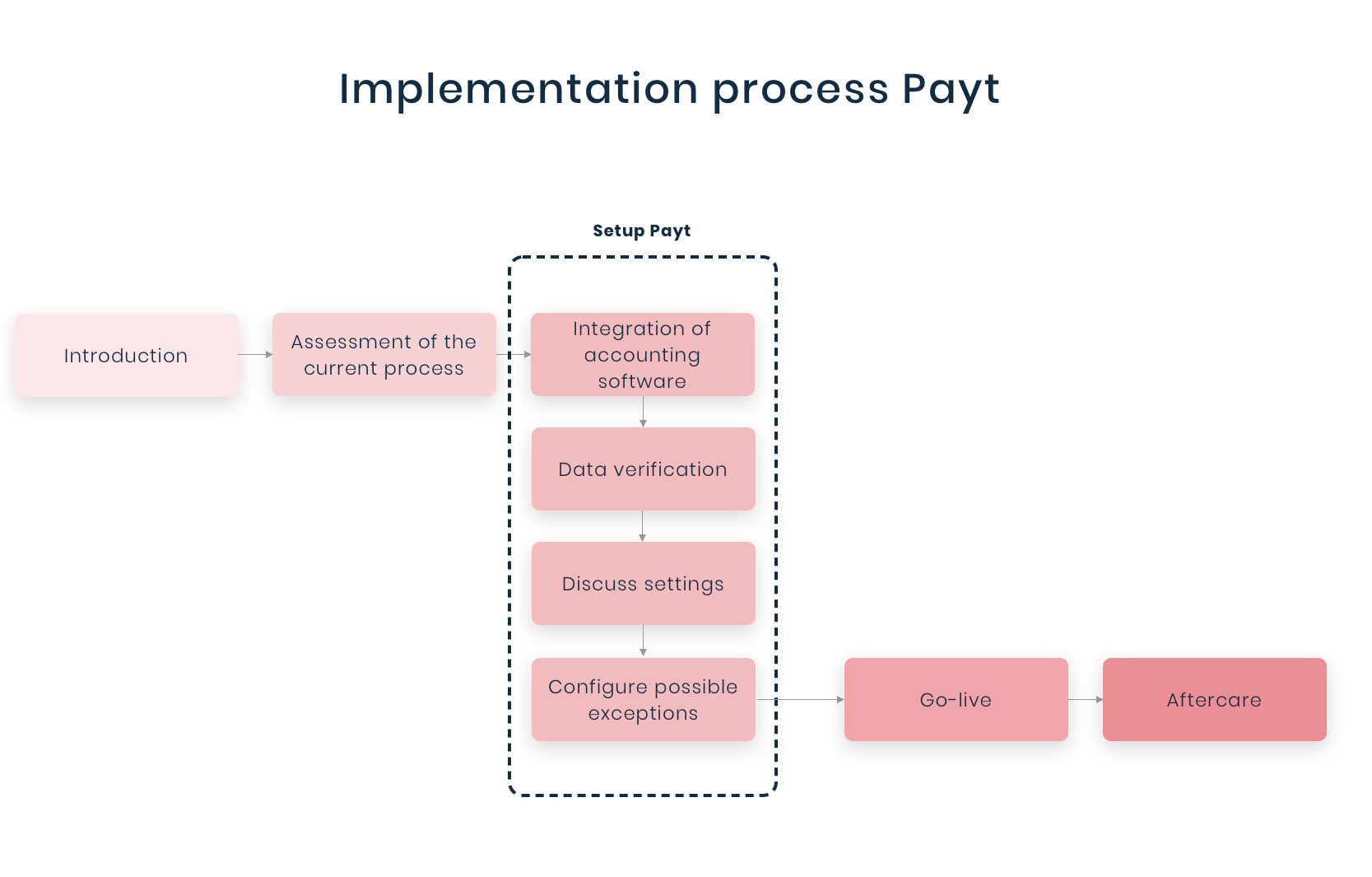

Before discussing the content, we always first get to know the customer. Through this introductory meeting, we try to establish short lines of communication between Payt and the customer. Additionally, the introductory meeting is intended to discuss how accounts receivable management is currently organized. This ensures that my colleague and I can offer a tailor-made solution within Payt’s ‘standard package’.

After the introductory meeting and inventory of the current processes, we determine the setup of Payt. We try to automate the customer’s current accounts receivable management process within Payt. This way, little changes for the debtors, and management by our customer becomes more efficient and effective. Within the standard package, we have many possibilities to achieve this. A stable foundation is first created before exceptions are addressed and configured. To establish this stable foundation, several standard points will be reviewed. For ease of use and overview, a handy checklist is available in the application, so these points can be easily checked off. This also provides a good insight into the status of the Payt implementation and the automation of the accounts receivable management of the respective customer.

- Link with accounting package

- Check data

- Discuss settings

- Perform final check

- Go live

With the completion of the above points, the customer can start using Payt within a week. However, the duration of the implementation is highly dependent on the complexity of the project. If the underlying processes are complicated, it requires a longer lead time. The experience is that large customers with more complex processes can start with Payt within a month.

Once the foundation of Payt is in place, if necessary, the focus can shift to the exceptions to the rule. Together, we look for the most suitable setup for these exceptions. It is important that the customer keeps in mind that their own working method may need to be adjusted to fully automate the process.

We try to relieve and support our customers as much as possible in the process towards full automation.

– Bert-Jan Walters

Is the administration live? Then you are still not alone. We maintain a standard aftercare period of about two weeks. During this period, you can still use the consultant who guided you through the implementation. If everything is in order after those two weeks, the standard route for questions is our Payt service desk.

Yes, it is a change, yes, it is exciting, but you are always supported by an experienced consultant, and the go-live only takes place when you are truly ready.

Does this process sound appealing and simple to you? Then schedule a demo below!