Managing debtors is a time-consuming task for many companies, especially when dealing with a large number of customers and invoices. If you want to automate debtor management, you will find that it provides significant relief and makes payment processes more efficient. With our debtor software, your company can benefit from workflow automation, automatic reminders, and real-time insight into outstanding items. This leads to faster payments, improved cash flow, and less administrative hassle. Discover the benefits at Payt.

Reasons to automate debtor management

One of the main reasons to choose to automate debtor management is the ability to work more efficiently. With automatic invoicing and reminder emails, the process is structured and consistent. This ensures better follow-up on payments and fewer delays in payment processing. Additionally, real-time monitoring provides the ability to always have insight into the current situation, allowing for quick intervention if necessary.

Automation not only prevents human errors but also ensures that your customers are reminded of their payment obligations at the right time. This reduces the need to engage a collection agency.

The benefits for your company

Automating your debtor management offers numerous benefits. One of the biggest advantages is time savings. Sending invoices and payment reminders happens automatically, meaning you can focus on other important matters within your company. Payt’s debtor software ensures that this process is fully automated, without the need for manual intervention.

Additionally, automation improves payment processing. By using API integrations, the software can seamlessly work with your existing systems, such as accounting software or CRM tools. This leads to more efficient data exchange and a more accurate overview of outstanding invoices and creditors.

Another advantage is the ability for data analysis and risk analysis. By using the software for KPI tracking, you can gain insight into the payment behaviour and creditworthiness of customers and identify potential risks in a timely manner. This allows you to act proactively and prevents overdue payments from negatively affecting your cash flow. Moreover, the software provides detailed reports that allow you to monitor and optimise the performance of debtor management.

How to automate debtor management?

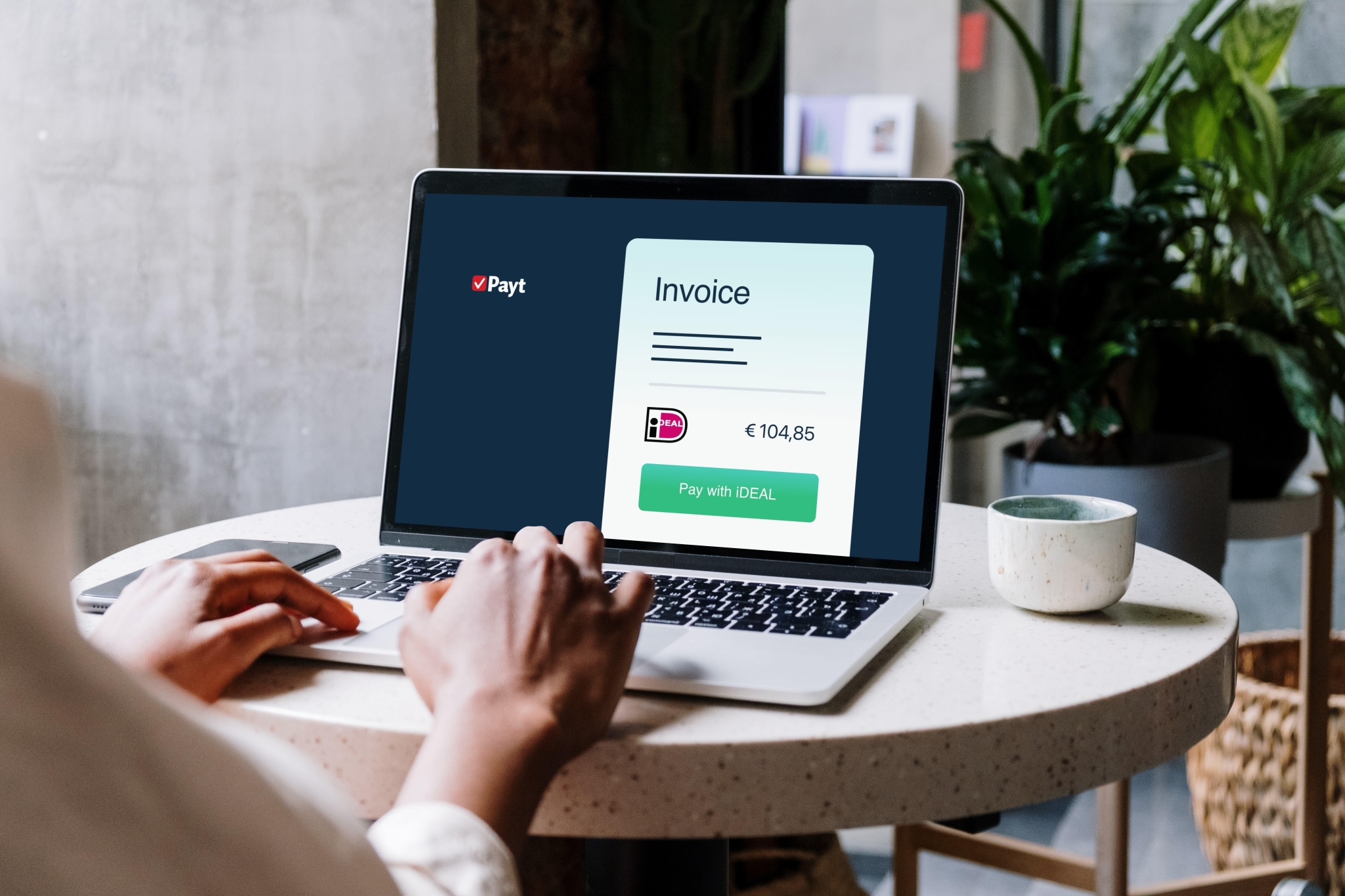

Automating debtor management starts with implementing the right automation software. Our software automates the entire process, from automatic invoicing to sending reminders and dunning letters. This ensures that outstanding items are followed up on time and reduces the risk of late payments.

The software also offers an integrated dashboard that provides an overview of all outstanding items at a glance. With real-time monitoring, you can track the progress of each invoice and quickly respond to any payment arrears. This provides more control over the debtor management process and makes it easier to make decisions based on current data.

Automate debtor management with Payt

At Payt, we offer advanced debtor management software that helps companies automate their debtor management. This allows you to benefit from smart technologies such as machine learning, which enables you to analyse and predict customer payment behaviour. This helps optimise cash flow and reduces the risk of bad debts.

Outsource Debtor Management?

Do you want to outsource debtor management and use our innovative software? Request a demo today and discover how our software can support your company. During the demo, you will receive a comprehensive explanation of the software’s capabilities and see how Payt can improve your payment processing. Our specialists are ready to answer your questions and work with you to see how Payt best meets your company’s needs.

Frequently asked questions

What are the benefits of automating debtor management?

By automating debtor management, you save time and money. Automation ensures more efficient payment processing, real-time monitoring, and improved cash flow. You always have insight into outstanding invoices and can respond more quickly to payment arrears.

How does debtor management software work?

Debtor management software automates tasks such as sending invoices and reminder emails. It provides a clear dashboard with real-time data on outstanding items and integrates with your existing accounting and CRM systems via API connections.

Can I also outsource debtor management?

Yes, you can choose to outsource the entire debtor management to an external service provider like Payt. This reduces administrative burdens and provides access to professional expertise, making it more effective to address payment arrears.