Invoicing is the process of creating and sending an invoice to a customer for products or services delivered. It’s a crucial part of your financial administration and directly impacts your cash flow.

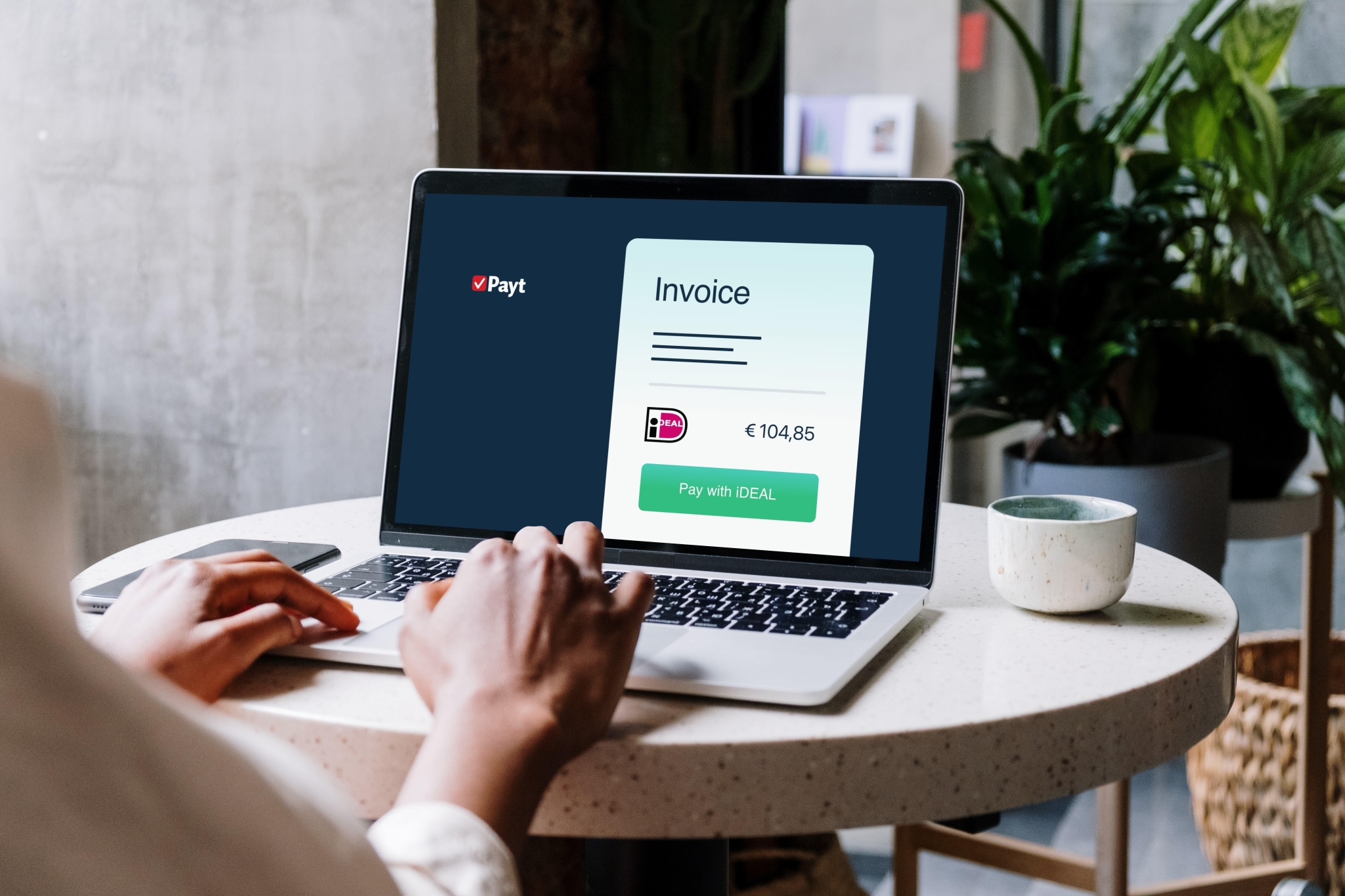

In this article, we’ll walk you through how invoicing works, what to look out for, and how smart software like Payt can make your invoicing process easier and more efficient.

Table of contents: