Allowance and allocation for doubtful debts

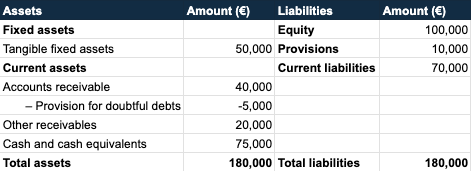

The provision for doubtful debts is a reservation on the balance sheet. This means you recognize the risk that part of your receivables may never be collected. You reduce your asset position with an estimate of this potential loss, giving your financial statements a more accurate picture.

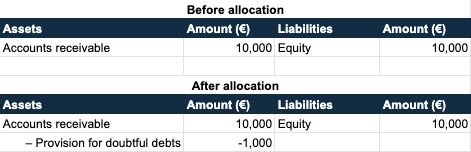

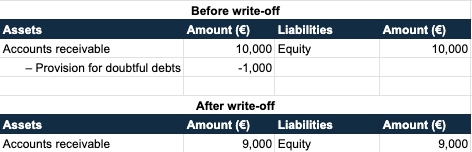

An allocation (or dotation) is the amount you add to this provision. As soon as there is a real risk that invoices will not be paid, you record the allocation as an expense. This is sometimes compared to the difference between allowance for doubtful accounts vs bad debt expense: the allowance adjusts the balance sheet, while the expense impacts the income statement.