10 tips to get invoices paid faster

1. Send your invoice immediately after delivery

The sooner you invoice, the sooner you get paid. Many businesses still wait until the end of the month. But by sending invoices right after delivering a product or completing a service, you accelerate the payment cycle. Your client is still engaged, which increases the chance of fast payment.

2. Motivate your customers to pay on time

Encourage early payment with small discounts or by highlighting benefits of quick payment. A clear due date with advantages creates a psychological incentive.

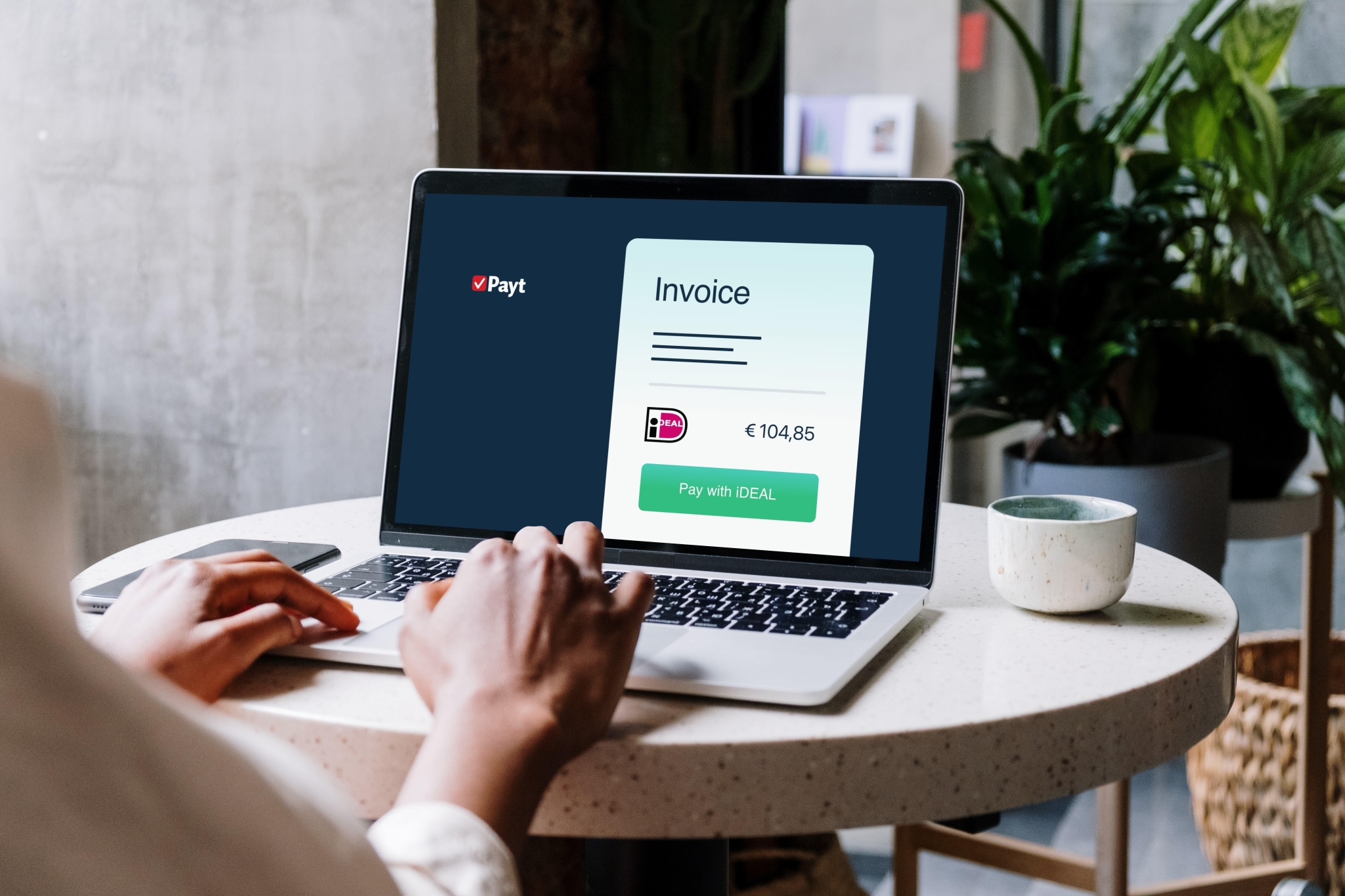

3. Add an iDEAL payment link to your invoices and reminders

Convenience drives faster payment. Adding an iDEAL link lowers the barrier to pay immediately.

Research shows that invoices with an iDEAL link get paid 9 days faster on average.

4. Communicate clearly on your invoice

A correct invoice avoids unnecessary delays. Always include:

- correct invoice date and reference

- clear description of goods or services

- correct VAT rate

- due date

Any mistake invites questions—and delays.

5. Automate your payment reminders

Many companies wait too long to follow up. With automated reminders, you send the right message at the right time—friendly, professional, and timely.

Payt users save up to 80% of their time with automated follow-up.

6. Send a reminder before the due date

Don’t wait until a payment is overdue. A reminder a few days before the due date improves the chances of on-time payment. It reduces the risk of your invoice being forgotten.

Example: If the due date is July 30, send a message on July 27 like:

“Just a quick note: invoice 2024-127 is due soon. Any questions or is everything clear?”

7. Keep personal contact with your clients

When payment is late, a personal message can go a long way. Call or email to show you care. That often results in fast action.

Example: “Hi [name], I noticed invoice X is still open. Can I help with anything?”

8. Use fixed payment dates

Encourage clients to pay on fixed days (e.g., the 1st or 15th of the month). This adds structure to their process and your expectations. Many large organizations already do this.

Research from IFF (2024) shows that fixed payment days significantly increase on-time payments.

9. Check the creditworthiness of new clients

A simple creditworthiness check can save you trouble. If you find a higher risk, ask for advance payment or shorter terms.

Use services like Graydon CreditSafe. Payt also lets you check customer credit scores directly on the platform.

10. Analyze your outstanding invoices

Knowing your open invoices helps you detect risks early. With proper insight into your accounts receivable, you can see who consistently pays late, where large amounts are unpaid, or which sectors show higher risk.

With Payt’s reporting, you can segment customers by behavior, prioritize follow-ups, and decide when to escalate or adjust terms.