More control and less work. Even in your industry.

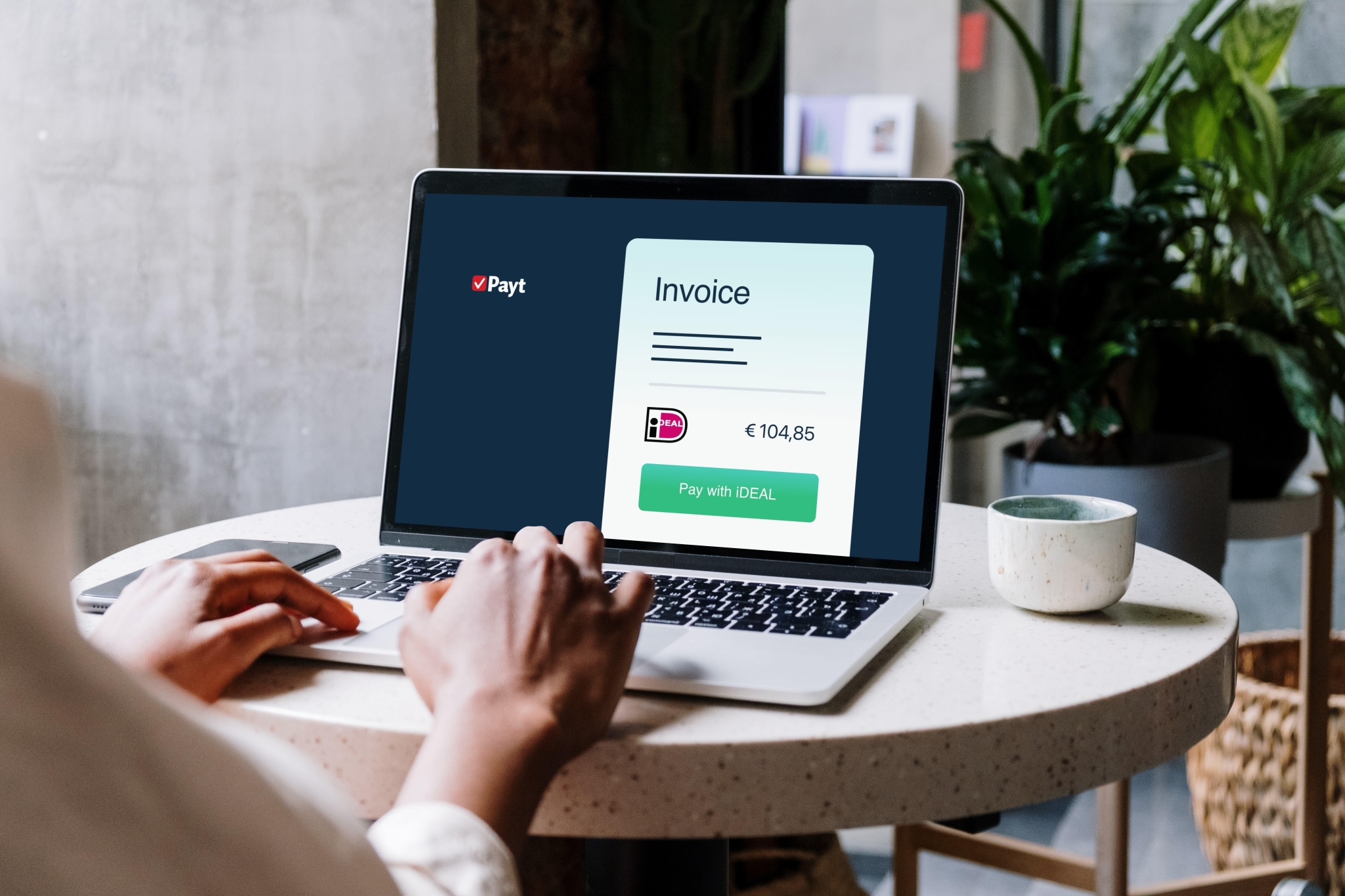

Fast and secure invoice processing for every organization.

Fast and secure invoice processing for every organization

Choose your country

Getting started with Payt?

Book a demo with Thymen.

Thymen Osinga

AdvisorTake a moment to review everything.

Do you have any questions about our software? Our advisors are ready to help you!