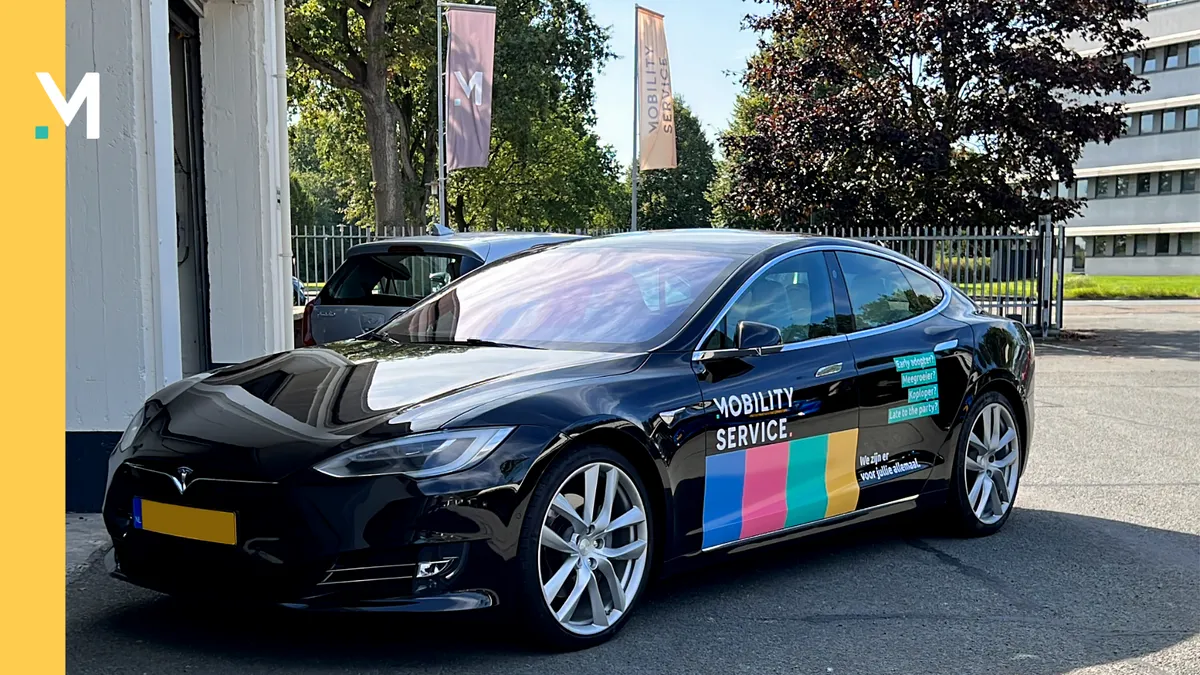

Every day, approximately 3,500 cars from Mobility Service drive on Dutch roads. The business leasing company from Eelde helps its customers with a suitable mobility solution; from full operational lease and net operational lease to purchasing an entire fleet. “Flexibility is characteristic of Mobility Service,” says Inge Mier, Financial & Operational Director. “Both in our services and in our customer service. If a customer calls asking if we can have a car ready for them that afternoon, we do it.”

Everything flexible

The leasing company is doing well in the flexible sector. “That’s because companies can just as easily enter into a short lease as a long lease contract with us,” Inge explains. “Many of our customers have a mixed workforce. Such a company wants a long lease contract for permanent employees, but a short lease contract for temporary staff.” Not every leasing company offers this possibility, which is why Mobility Service is doing well in the flexible sector. “We count many staffing agencies among our clientele.”

That Mobility Service is a progressive leasing company is evident not only from its services. The company was one of the first customers of Payt. “Although I wasn’t working at Mobility Service at the time, I know that Payt played an important role in optimizing our debtor management,” Inge says. Previously, the company did everything manually. Every few weeks, they would print out the debtor list and call everyone who hadn’t paid the invoice within the payment term.