Step-by-step guide: how to write an invoice letter

Use the six steps below to create a professional invoice letter that fits your business:

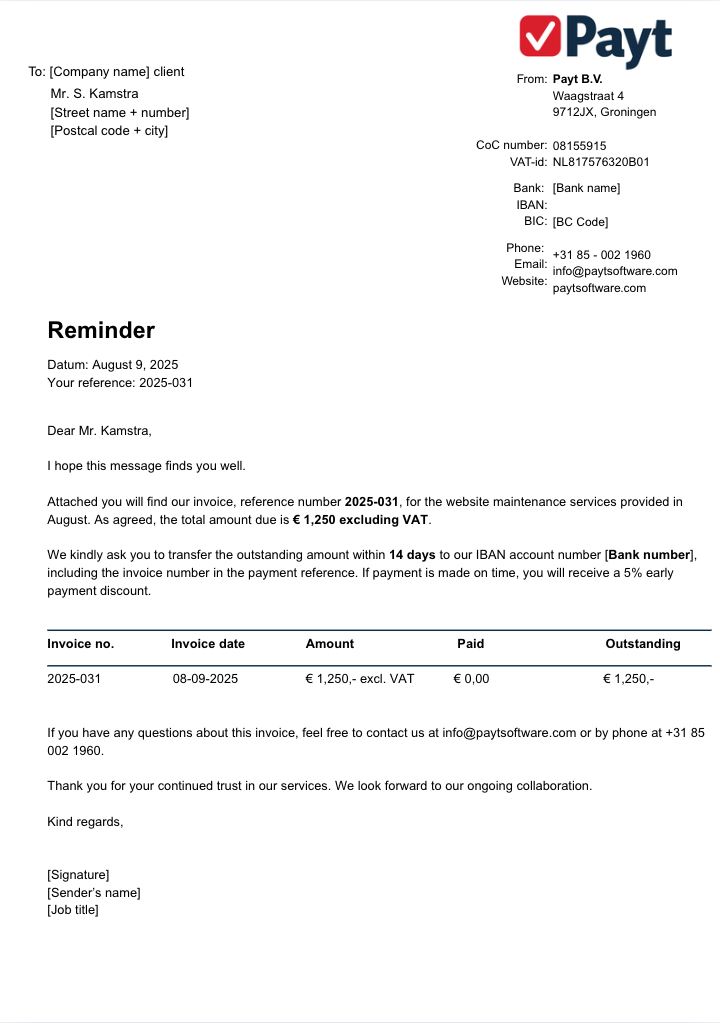

Step 1: Create a reusable template

Start with a blank document or email template. Include your logo, company name, and tone of voice. A consistent layout adds professionalism and saves time.

Step 2: Add your company information

Top left corner:

- Your name

- Company name

- Street address

- Zip code + City

- Date

Step 3: Enter the recipient’s details

Clearly address the invoice to the correct contact. Include:

- Full name

- Job title

- Company name

- Address

Step 4: Start with a friendly greeting

Use a personal salutation and a brief introductory line:

Dear Mr. Johnson,

I hope this message finds you well.

Step 5: State the purpose clearly

Go straight to the point. Let the recipient know what the invoice is for and what is expected.

Please find attached invoice 2023-015 for website maintenance in August. Payment is due within 14 days. A 5% discount applies if paid on time.

For any questions, contact [email address or phone number].

Step 6: Close professionally

Thank you in advance,

[Signature]

[Your name]

Attachment: Invoice 2023-015