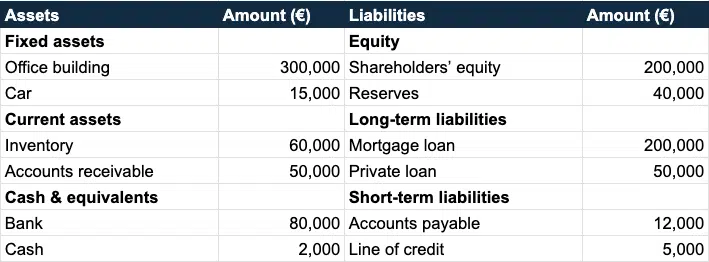

A balance sheet, in accounting terms, refers to an overview of all assets and liabilities. The balance with liabilities and assets is always in equilibrium.

What sides does the balance sheet have?

A balance sheet with an overview of assets and liabilities consists of two sides. The left side contains the assets and is the debit side, while the right side contains the liabilities and is the credit side. It is always a snapshot and the overview provides insight into the financial state of your organization.

What is on the balance sheet?

On the left, on the debit side, all assets are listed. This includes possessions such as the value of a company building or a company car, as well as other investments. This involves fixed assets, but there are also current assets. Some examples of assets are the inventories within a company as well as outstanding receivables from debtors. The inventory in the company, a company building, and the cash account are also examples of assets.

All outstanding items can also be found on the balance sheet. The liabilities on the right side form the credit side and include equity and borrowed capital, which can be distinguished into long-term and short-term liabilities. A debt to a creditor is considered short-term liability, and a business loan is considered long-term liability. The credit side thus reflects all financial debt obligations. Want to read more about capital? Here we explain what capital is.

Balance sheet example

Of course, it is useful to see an example balance sheet to get a good insight into the overview of assets and liabilities or assets and liabilities. Take a look below.